IRS Announces 2023 Estate & Gift Tax Exemption Amounts - Texas Agriculture Law

Recently, the IRS announced the 2023 estate and gift tax exemption amounts. These amounts change slightly each year, and are an important consideration in a person’s estate planning process. As we have previously discussed the IRS sets a certain amount that a person is allowed to give during their lifetime or at death without estate or gift tax liability. [Read prior blog posts here and here.] The IRS adjusts the amount each year. For 2023, the exemption amount will be $12.92 million per person, up from $12.06 million Read More →

2023 Estate Planning Update

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023

Lease Accounting Standards

2023 Estate and Gift Tax Rates: What You Need to Know

USDA ERS - Federal Estate Taxes

Ag Law in the Field Podcast: Episodes 111- 140 - Texas Agriculture Law

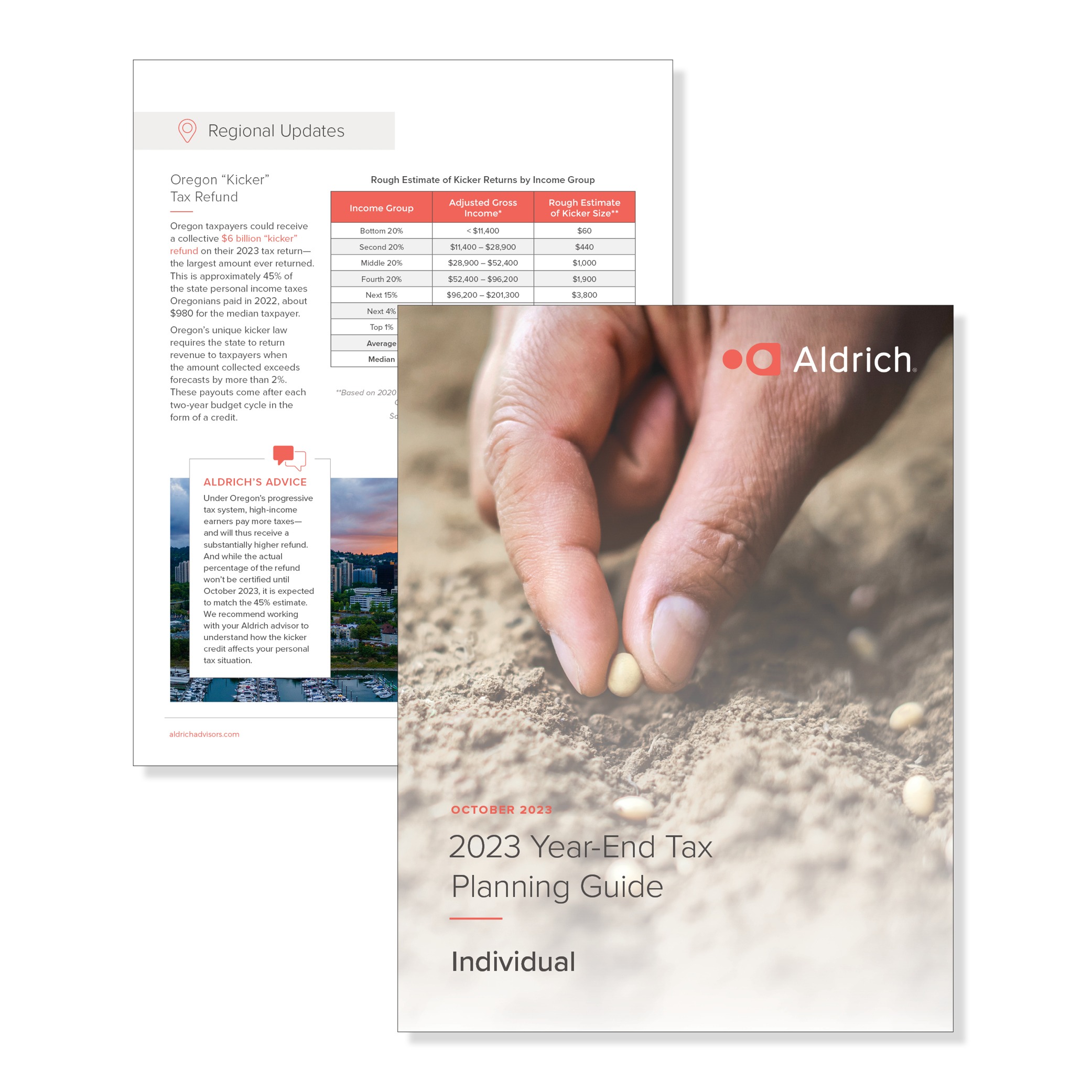

2023 Year-End Tax Guide for Individuals

Gift Tax Limit 2024: How Much Can You Give Tax-Free?

Gift and Estate Tax Exemption Limits Increase for 2024 - Texas Trust Law

IRS Announces Estate And Gift Tax Exemption Amounts For 2023 - Seder & Chandler, LLP

2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz & Smith, LLP

Legal Ease: IRS announces increase to federal gift and estate tax exemption amounts for 2024 – The Times Herald

Employee Benefits Year-End Checklist 2022